What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates independently of a central authority, such as a government or financial institution. Unlike traditional currencies like the US dollar or the euro, cryptocurrencies are decentralized and typically utilize blockchain technology to maintain a public ledger of all transactions.

Some key features of cryptocurrencies include:

- Decentralization: Cryptocurrencies are typically decentralized networks that operate on a peer-to-peer basis, meaning transactions occur directly between users without the need for intermediaries like banks.

- Security: Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units. This makes them resistant to fraud and counterfeiting.

- Transparency: Many cryptocurrencies operate on public blockchains, which are distributed ledgers that record all transactions across a network of computers. This transparency helps to ensure the integrity of the system.

- Limited Supply: Most cryptocurrencies have a limited supply, meaning there is a maximum number of coins or tokens that can ever be created. This scarcity can contribute to their value over time.

- Digital nature: Cryptocurrencies exist purely in digital form and do not have a physical counterpart like traditional currencies. They are stored in digital wallets and can be transferred electronically.

Bitcoin, created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto, was the first cryptocurrency and remains the most well-known and widely used. However, thousands of other cryptocurrencies have been created since then, each with its own unique features and purposes. Examples of other popular cryptocurrencies include Ethereum, Ripple (XRP), Litecoin, and Cardano.

how to invest in Cryptocurrency?

Investing in cryptocurrency can be done through various methods, but it’s important to approach it with caution and do thorough research due to the high volatility and risk associated with the cryptocurrency market. Here are some steps to consider if you’re interested in investing in cryptocurrency:

- Research: Before investing in any cryptocurrency, take the time to research and understand the technology behind it, its use case, the team behind the project, and its potential for future growth. Make sure to also research the risks involved, including regulatory uncertainty and market volatility.

- Choose a reliable exchange: To buy and sell cryptocurrencies, you’ll need to use a cryptocurrency exchange. Choose a reputable exchange with a user-friendly interface, strong security measures, and a good track record. Some popular cryptocurrency exchanges include Coinbase, Binance, Kraken, and Gemini.

- Create an account: Once you’ve chosen an exchange, sign up for an account and complete any necessary verification steps, such as providing identification documents and setting up two-factor authentication for added security.

- Fund your account: Deposit funds into your exchange account using a bank transfer, credit/debit card, or other accepted payment methods, depending on the exchange’s options.

- Choose your cryptocurrencies: Decide which cryptocurrencies you want to invest in based on your research and investment goals. Bitcoin and Ethereum are often popular choices for beginners, but there are thousands of other cryptocurrencies to choose from.

- Make your investment: Use the funds in your exchange account to buy the cryptocurrencies of your choice. You can typically place market orders to buy at the current market price or set limit orders to buy at a specific price.

- Consider storage options: After purchasing cryptocurrencies, consider transferring them to a secure wallet for long-term storage. Hardware wallets, such as Ledger Nano S or Trezor, offer offline storage and are considered one of the safest options. Alternatively, you can use software wallets or mobile wallets, but be sure to research their security features and backup procedures.

- Monitor your investments: Keep track of the performance of your investments and stay informed about developments in the cryptocurrency market. Set realistic investment goals and consider diversifying your portfolio to reduce risk.

- Practice risk management: Only invest what you can afford to lose and consider diversifying your investments across different assets to mitigate risk. Additionally, consider setting stop-loss orders to automatically sell your cryptocurrencies if their price falls below a certain threshold.

- Stay informed: Stay up-to-date with news and developments in the cryptocurrency space, as regulatory changes, technological advancements, and market trends can all impact the value of your investments.

Remember that investing in cryptocurrency carries inherent risks, and prices can be extremely volatile. It’s essential to do your own research, seek advice from financial professionals if needed, and only invest money you can afford to lose.

Best Altcoins to Invest in 2024 Bull Run:

Ethereum

Ethereum is a decentralized, open-source blockchain platform that enables developers to build and deploy smart contracts and decentralized applications (DApps). It was proposed by Vitalik Buterin in late 2013 and development was crowdfunded in 2014, with the network going live on July 30, 2015.

Here are some key features and aspects of Ethereum:

- Smart Contracts: Ethereum introduced the concept of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Smart contracts enable developers to create decentralized applications for various purposes, including finance, gaming, supply chain management, and more.

- Ethereum Virtual Machine (EVM): The Ethereum platform runs on the Ethereum Virtual Machine, a decentralized runtime environment that executes smart contracts. The EVM allows for the execution of code in a trustless and deterministic manner across the Ethereum network.

- Ether (ETH): Ether is the native cryptocurrency of the Ethereum platform. It is used as fuel to pay for transaction fees and computational services on the network. Additionally, it serves as a medium of exchange within the Ethereum ecosystem.

- Decentralization: Like Bitcoin, Ethereum operates on a decentralized network of nodes, meaning it is not controlled by any single entity or organization. This decentralization enhances security and censorship resistance.

- Proof of Stake (PoS) Transition: Ethereum is in the process of transitioning from a Proof of Work (PoW) consensus mechanism to a Proof of Stake (PoS) mechanism as part of Ethereum 2.0. This transition aims to improve scalability, energy efficiency, and security.

- Scalability: Scalability has been a significant concern for Ethereum due to limitations in transaction throughput and high gas fees during periods of network congestion. Ethereum 2.0 aims to address these scalability issues through technologies like sharding and PoS.

- Ecosystem and Development Community: Ethereum has a vibrant ecosystem and a large community of developers contributing to its development. This ecosystem includes tools, libraries, frameworks, and decentralized finance (DeFi) applications built on the Ethereum platform.

- Use Cases: Ethereum’s versatility allows for a wide range of use cases beyond simple peer-to-peer transactions. It has been utilized for crowdfunding through Initial Coin Offerings (ICOs), creating decentralized exchanges, non-fungible tokens (NFTs), decentralized finance (DeFi), and more.

Overall, Ethereum has played a significant role in shaping the blockchain and cryptocurrency industry, serving as a platform for innovation and the development of decentralized applications. Its continued evolution with Ethereum 2.0 aims to address scalability issues and further enhance its capabilities.

Gala

Gala is a cryptocurrency and blockchain project that focuses on the gaming industry. The Gala Games ecosystem aims to decentralize gaming and empower both players and developers by leveraging blockchain technology. Here are some key aspects of Gala:

- Gala Token (GALA): GALA is the native cryptocurrency of the Gala Games ecosystem. It is used for various purposes within the platform, including purchasing in-game assets, participating in governance decisions, and rewarding players and developers.

- Blockchain Infrastructure: Gala Games utilizes blockchain technology to provide transparency, security, and ownership of in-game assets. By recording transactions on a blockchain, players have true ownership of their digital items, which can be traded or transferred outside of the game environment.

- Play-to-Earn Gaming: Gala Games promotes the concept of “play-to-earn” gaming, where players can earn rewards or tokens by participating in and contributing to the gaming ecosystem. This can include earning GALA tokens, receiving rare in-game assets, or obtaining other incentives.

- Gala Games Studio: Gala Games operates its own game development studio, creating original games designed to integrate blockchain technology and provide unique gaming experiences. Some of the games developed by Gala Games include Townstar, Mirandus, and Fortified.

- Gala Nodes: Gala Games operates a decentralized network of Gala Nodes, which serve various functions within the ecosystem, such as validating transactions, hosting game servers, and contributing to the security of the network. Node operators are rewarded with GALA tokens for their participation.

- Community and Governance: The Gala Games ecosystem is driven by its community, which participates in governance decisions through decentralized governance mechanisms. GALA token holders have the opportunity to vote on proposals and influence the direction of the platform.

Overall, Gala aims to revolutionize the gaming industry by providing a decentralized platform where players can truly own their in-game assets and participate in the ecosystem’s governance. As blockchain technology continues to evolve, projects like Gala Games demonstrate the potential for innovation and disruption in the gaming sector.

Cardano

Cardano is a blockchain platform and cryptocurrency project that aims to provide a more secure, scalable, and sustainable infrastructure for the development and execution of smart contracts and decentralized applications (DApps). It was founded by Charles Hoskinson, one of the co-founders of Ethereum, and launched in September 2017.

Here are some key aspects of Cardano:

- Proof of Stake (PoS) Consensus Mechanism: Cardano utilizes a PoS consensus mechanism called Ouroboros, which aims to achieve scalability and energy efficiency while maintaining security. PoS allows participants to stake their ADA (the native cryptocurrency of Cardano) as collateral to participate in the block validation process and earn rewards.

- Layered Architecture: Cardano is built on a layered architecture, which separates the platform into distinct layers responsible for different functions. These layers include the Cardano Settlement Layer (CSL), responsible for handling transactions and ADA, and the Cardano Computation Layer (CCL), designed to support smart contracts and DApps.

- Formal Verification and Peer Review: Cardano emphasizes rigorous academic research, formal methods, and peer-reviewed development processes to ensure the security and reliability of its protocol. This approach aims to minimize bugs, vulnerabilities, and other issues commonly associated with blockchain platforms.

- Scalability and Interoperability: Cardano is designed to address scalability and interoperability challenges faced by many blockchain platforms. Through its layered architecture, scalability improvements, and interoperability features, Cardano aims to support a wide range of applications and use cases.

- Governance and Sustainability: Cardano incorporates a decentralized governance model that allows ADA holders to participate in decision-making processes through voting and delegation. Additionally, Cardano aims to achieve sustainability by incentivizing network participants to contribute to its growth and maintenance.

- Partnerships and Use Cases: Cardano has established partnerships with various organizations and entities to explore real-world applications of its technology. These use cases span sectors such as finance, identity management, supply chain, and governance, demonstrating the potential impact of Cardano beyond the cryptocurrency space.

- Community and Development: Cardano has a vibrant and active community of developers, researchers, and enthusiasts contributing to its development and ecosystem growth. The Cardano Foundation, IOHK (Input Output Hong Kong), and EMURGO are key entities driving the project forward.

Overall, Cardano aims to provide a robust and sustainable infrastructure for the decentralized economy, enabling secure and scalable transactions, smart contracts, and DApps. As the project continues to evolve and expand its capabilities, it seeks to address some of the key challenges facing the blockchain industry and drive adoption across various sectors.

Chainlink

Chainlink (LINK) is a decentralized oracle network and cryptocurrency. It aims to bridge the gap between smart contracts on the blockchain and real-world data, enabling smart contracts to interact with external data sources securely and reliably. Here are some key points about Chainlink:

- Decentralized Oracle Network: Chainlink provides a decentralized oracle network composed of nodes that retrieve and verify real-world data, such as prices, weather conditions, or sports scores. This data is then made accessible to smart contracts on various blockchain platforms, including Ethereum, enabling them to execute based on real-world events.

- Security and Reliability: Chainlink aims to provide tamper-resistant and reliable data feeds to smart contracts. Its decentralized network of nodes ensures data accuracy and integrity by aggregating information from multiple sources and using cryptographic techniques to verify its authenticity.

- Adoption and Integration: Chainlink has seen significant adoption and integration within the blockchain ecosystem. It is widely used by decentralized finance (DeFi) applications to access price feeds for assets, facilitate lending and borrowing protocols, and enable derivatives trading. Additionally, Chainlink’s technology is utilized in various other industries, including supply chain management, insurance, gaming, and more.

- LINK Token: The native cryptocurrency of the Chainlink network is called LINK. It serves multiple purposes within the ecosystem, including payment for oracle services, incentivizing node operators to provide accurate data, and participating in governance decisions through staking and voting.

- Team and Development: Chainlink was founded by Sergey Nazarov and Steve Ellis in 2017. The project has a dedicated team of developers and researchers continuously improving its technology and expanding its capabilities. Chainlink Labs, the organization behind the project, collaborates with industry partners, developers, and blockchain communities to drive adoption and innovation.

- Community and Partnerships: Chainlink has a strong and active community of supporters, developers, and node operators contributing to its growth and adoption. The project has formed strategic partnerships with leading blockchain projects, enterprises, and academic institutions to explore use cases and integrate oracle solutions into various applications.

Overall, Chainlink plays a crucial role in enabling smart contracts to access real-world data, extending the capabilities of blockchain technology and facilitating the development of decentralized applications across multiple industries. Its focus on security, reliability, and decentralization has positioned it as a key player in the blockchain ecosystem.

Dogecoin

Dogecoin (DOGE) is a cryptocurrency that started as a joke or meme based on the popular “Doge” meme featuring a Shiba Inu dog. Despite its origins, Dogecoin has grown into a widely recognized and utilized digital currency with a vibrant community. Here are some key aspects of Dogecoin:

- History and Origins: Dogecoin was created in December 2013 by software engineers Billy Markus and Jackson Palmer as a light-hearted and fun alternative to Bitcoin. It was initially intended to be a parody cryptocurrency, but it gained popularity quickly due to its meme appeal and friendly community.

- Symbol and Mascot: The Dogecoin logo features the iconic Shiba Inu dog from the “Doge” meme, often depicted with colorful Comic Sans text in broken English. This playful and lighthearted branding has contributed to Dogecoin’s unique identity and widespread recognition.

- Blockchain and Technology: Dogecoin is based on the same technology as other cryptocurrencies, utilizing a decentralized blockchain to record transactions securely. It operates on a proof-of-work (PoW) consensus mechanism, similar to Bitcoin, where miners compete to validate transactions and secure the network.

- Community and Culture: Dogecoin has a strong and active community known for its generosity, sense of humor, and charitable initiatives. The community has organized various fundraisers and donation campaigns, including sponsoring athletes, supporting charitable causes, and contributing to disaster relief efforts.

- Use Cases and Adoption: While Dogecoin started as a joke, it has evolved into a widely accepted digital currency with various real-world use cases. It is used for tipping content creators on social media platforms, facilitating microtransactions, and as a store of value. Additionally, some businesses and merchants accept Dogecoin as a form of payment.

- Price Volatility and Speculation: Like many cryptocurrencies, Dogecoin’s price has been subject to volatility and speculation in the cryptocurrency market. Its price movements are influenced by factors such as market sentiment, investor demand, and broader trends in the cryptocurrency industry.

- Development and Updates: Dogecoin’s development is primarily community-driven, with contributions from developers and enthusiasts around the world. While the project has seen relatively fewer updates compared to some other cryptocurrencies, the community remains active in maintaining and improving the network.

Overall, Dogecoin’s unique branding, supportive community, and widespread adoption make it a notable presence in the cryptocurrency space. Despite its origins as a joke, Dogecoin has garnered a dedicated following and continues to attract attention both within and outside the cryptocurrency community.

Vechain

VeChain (VET) is a blockchain platform and cryptocurrency project that focuses on supply chain management, product authentication, and data verification. It aims to leverage blockchain technology to enhance transparency, traceability, and trust throughout the supply chain process. Here are some key aspects of VeChain:

- Origin and Development: VeChain was founded in 2015 by Sunny Lu, former CIO of Louis Vuitton China, under the name “VeChain Thor.” The project initially started as a subsidiary of BitSE, a blockchain technology company based in China. It later rebranded to VeChain and became an independent entity focused on enterprise blockchain solutions.

- Blockchain Infrastructure: VeChain operates on a public blockchain platform that allows businesses to create, deploy, and manage decentralized applications (DApps) tailored for supply chain management and product lifecycle tracking. The VeChainThor blockchain uses a proof-of-authority (PoA) consensus mechanism, which prioritizes transaction throughput and scalability while maintaining network security.

- Tokenization and Dual Token System: VeChain utilizes a dual-token system consisting of VeChain Token (VET) and VeThor Token (VTHO). VET serves as the native cryptocurrency of the VeChainThor blockchain, used for staking, transaction fees, and governance purposes. VTHO is a utility token generated by holding VET, used to pay for transaction costs and smart contract execution.

- Enterprise Adoption and Partnerships: VeChain has established partnerships with various enterprises across industries such as retail, luxury goods, logistics, automotive, and agriculture. These partnerships involve implementing VeChain’s blockchain technology to improve supply chain visibility, quality control, anti-counterfeiting measures, and consumer trust.

- Toolchain and Solutions: VeChain provides a suite of tools and solutions to streamline the integration of blockchain technology into existing business processes. This includes VeChain ToolChain, a platform-as-a-service (PaaS) solution that enables businesses to create and deploy blockchain-based applications without the need for extensive technical expertise.

- Real-World Use Cases: VeChain’s blockchain technology is applied to a wide range of real-world use cases, including product traceability, authenticity verification, cold chain logistics, carbon footprint tracking, and sustainability initiatives. By leveraging blockchain technology, VeChain aims to enhance efficiency, transparency, and sustainability across supply chains.

- Community and Development: VeChain has a dedicated community of developers, enthusiasts, and supporters contributing to its ecosystem’s growth and development. The project actively engages with its community through events, workshops, hackathons, and educational initiatives to promote blockchain adoption and innovation.

Overall, VeChain seeks to revolutionize supply chain management and product lifecycle tracking by leveraging blockchain technology to improve transparency, efficiency, and trust. With its focus on enterprise adoption, partnerships, and real-world applications, VeChain aims to address key challenges in various industries and drive digital transformation across the global supply chain ecosystem.

Shiba Inu

Shiba Inu (SHIB) is a cryptocurrency that gained popularity in 2021. It is named after the Shiba Inu dog breed, which is the same breed famously associated with the Dogecoin (DOGE) meme. Shiba Inu was created by an anonymous individual or group using the pseudonym “Ryoshi” and was introduced as an experiment in decentralized community building.

Here are some key aspects of Shiba Inu (SHIB):

- Tokenomics: Shiba Inu (SHIB) is an ERC-20 token on the Ethereum blockchain. It was initially launched as an experiment in decentralized governance and community-driven development. The token’s total supply is reported to be one quadrillion (10^15) SHIB tokens, with a large portion initially locked in a liquidity pool on Uniswap.

- Community and Memetic Appeal: Shiba Inu gained popularity through its association with the Dogecoin meme and its active community of supporters. Like Dogecoin, Shiba Inu has a playful and memetic appeal, with its branding featuring the Shiba Inu dog and references to “woofing” and “shibarity.”

- Use Cases and Projects: Shiba Inu has expanded beyond its initial token launch, with the creation of additional projects and tokens within the “Shiba ecosystem.” These include ShibaSwap, a decentralized exchange (DEX) built on the Ethereum blockchain, and other tokens such as Leash (LEASH) and Bone (BONE), which are part of the broader Shiba Inu ecosystem.

- Listing and Trading: Shiba Inu (SHIB) has been listed on various cryptocurrency exchanges, allowing users to buy, sell, and trade the token. Its availability on popular exchanges has contributed to its liquidity and trading volume.

- Speculation and Volatility: Like many meme-inspired cryptocurrencies, Shiba Inu (SHIB) has experienced significant price volatility and speculative trading activity. Its price movements are often influenced by market sentiment, social media trends, and broader developments in the cryptocurrency market.

- Risks and Considerations: Investors should be aware of the risks associated with investing in meme coins and speculative assets. These include price volatility, lack of fundamental value, regulatory uncertainty, and potential for market manipulation.

- Community and Development: Shiba Inu has a dedicated community of supporters and developers who contribute to its ecosystem’s growth and development. The community is actively involved in initiatives such as governance proposals, marketing campaigns, and community events.

Overall, Shiba Inu (SHIB) is a meme-inspired cryptocurrency that has garnered attention and gained a following within the cryptocurrency community. While it has captured the imagination of many enthusiasts, investors should approach it with caution and conduct thorough research before investing, considering the speculative nature of meme coins and their associated risks.

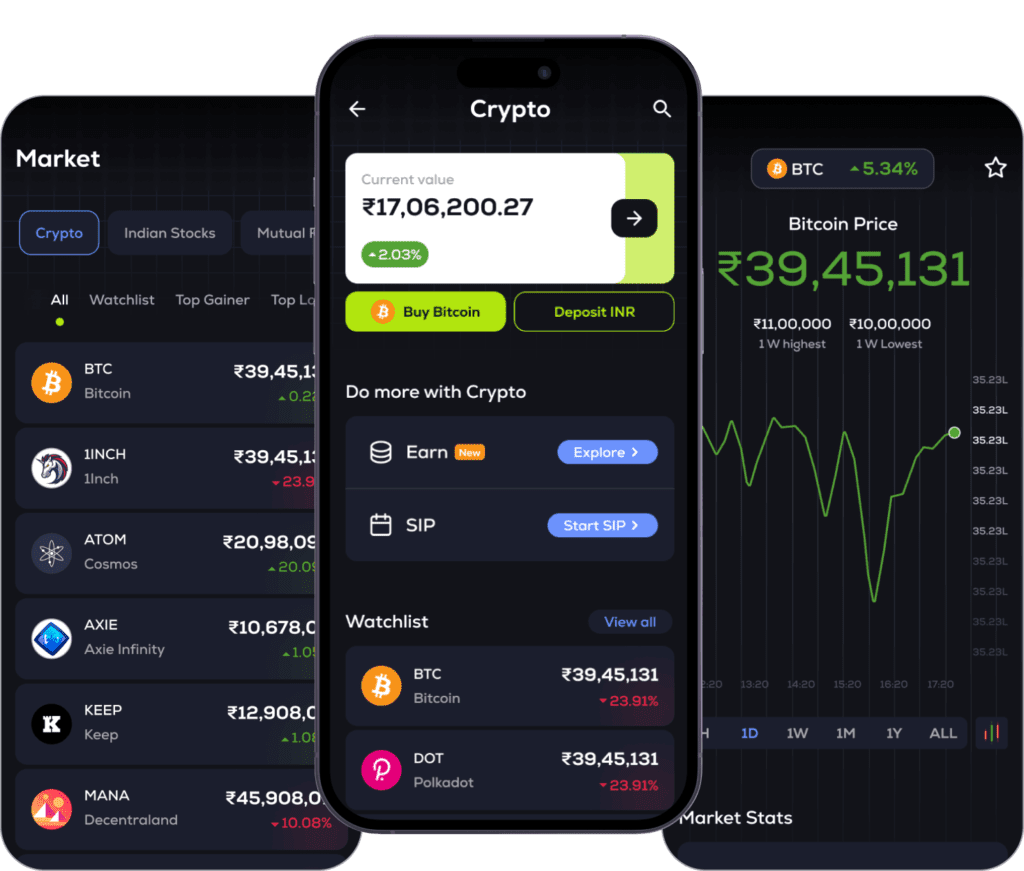

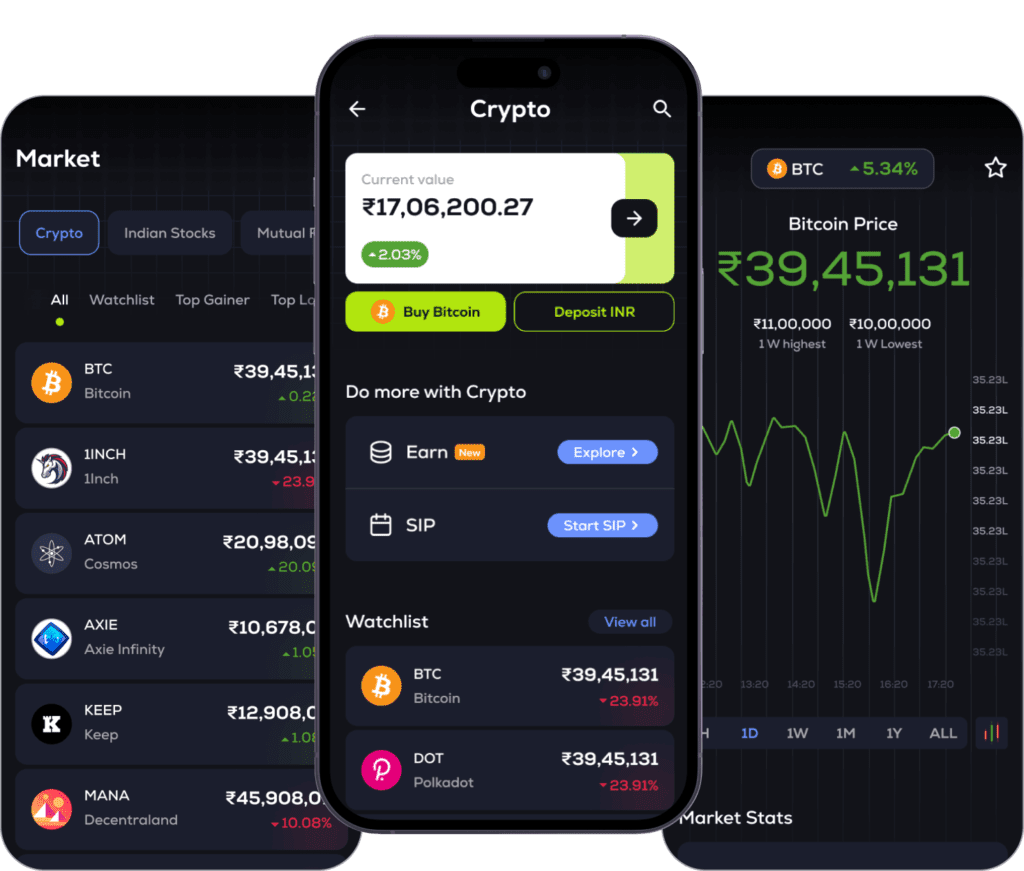

Start your Investment journey through CoinSwitch

Hey, get FREE BITCOIN worth Rs. 50 on downloading the CoinSwitch app using my referral link. Join me and 2 Crores traders who are trading in 100s of crypto. Hurry, use my link: https://coinswitch.co/in/refer?tag=wvVoB

Read our latest articles: https://genzfitness.in/